Ira Contribution Limits 2025 - 2025 Poverty Guidelines For Uscis. Updated guidance on uscis federal poverty guidelines [effective 2023] shilpa […] $6,500 (for 2023) and $7,000 (for 2025) if you’re under age 50;

2025 Poverty Guidelines For Uscis. Updated guidance on uscis federal poverty guidelines [effective 2023] shilpa […]

Aws Public Sector Summit 2025 Map. A plenary session will start the day. Official youtube […]

What Are The Ira Limits For 2025 Margo Sarette, $8,000 if you're age 50 or older. The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

New 2025 Ira Contribution Limits Phebe Brittani, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable.

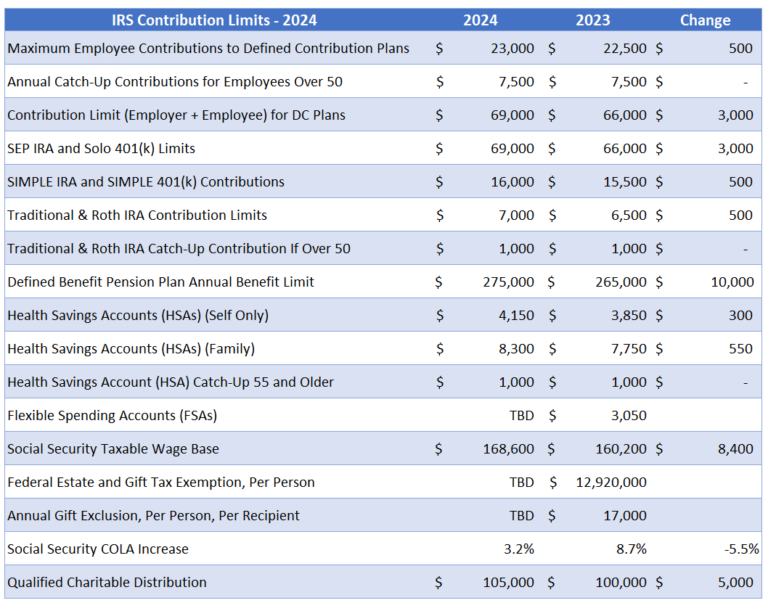

2025 Contribution Limits Announced by the IRS, The maximum contribution limit for roth and traditional iras for 2025 is: There are traditional ira contribution limits to how much you can put in.

This is an increase from 2023, when the limits were $6,500 and $7,500, respectively.

401k 2025 Contribution Limit Chart, If you withdraw before meeting these, any investment earnings will be taxed. The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

2025 ira contribution limits Inflation Protection, Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for individuals age 50 or older). The maximum contribution limit for both types.

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older. If you have roth iras, your income could affect how much you can contribute.

IRS Unveils Increased 2025 IRA Contribution Limits, As a couple, you can contribute a combined total of $14,000 (if you're both under 50) or $16,000 (if you're both 50 or older) to a traditional ira for 2025. New contribution and gifting limits for 2025.

Can You Still Contribute To 2025 Roth Ira Kenna Alameda, It's important to check the current limits and guidelines before making contributions. How much you can contribute is limited by your income level, filing status, and age.